In this blog, we recap a webinar discussing simplifying and optimizing processes in complex insurance product development.

Insurance companies are facing significant competitive pressures for new individualized products and services. The slow pace of digital advancement by insurance companies has hampered the product development process. Consider cumbersome regulatory oversight, legacy infrastructure, functional and team silos, and long-entrenched processes and culture, and you have a perfect recipe for lengthy development cycles that lead to time-to-market delays.

The reality is that insurance product development is becoming more and more complex, where product requirements need to be managed seamlessly without needless roadblocks. The carriers have been slow to adopt transformational technology, with many teams still using Word documents, spreadsheets, email, and lengthy meetings to make decisions — adding unnecessary time and risk to the development process.

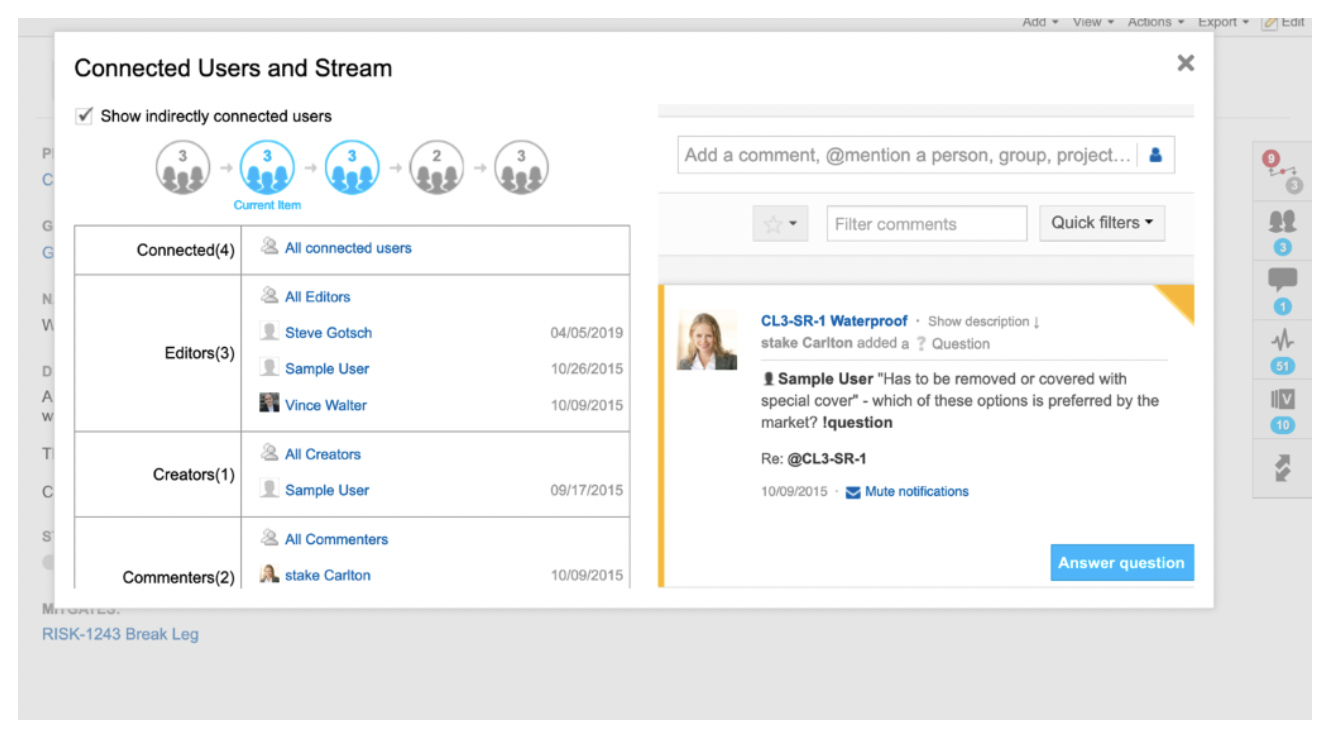

To overcome these challenges and deliver compliant, market-driven products, it’s vital that all stakeholders and business analysts can identify risks early on and establish connections with your development organization throughout the process.

In this webinar, Jama Software and industry experts Alan Demers and Carla Alavarez join forces to cover how to eliminate silos and increase efficiency by aligning teams across the entire product development lifecycle.

Learn more about how to deliver high-quality insurance products on time and on budget, with the ability to:

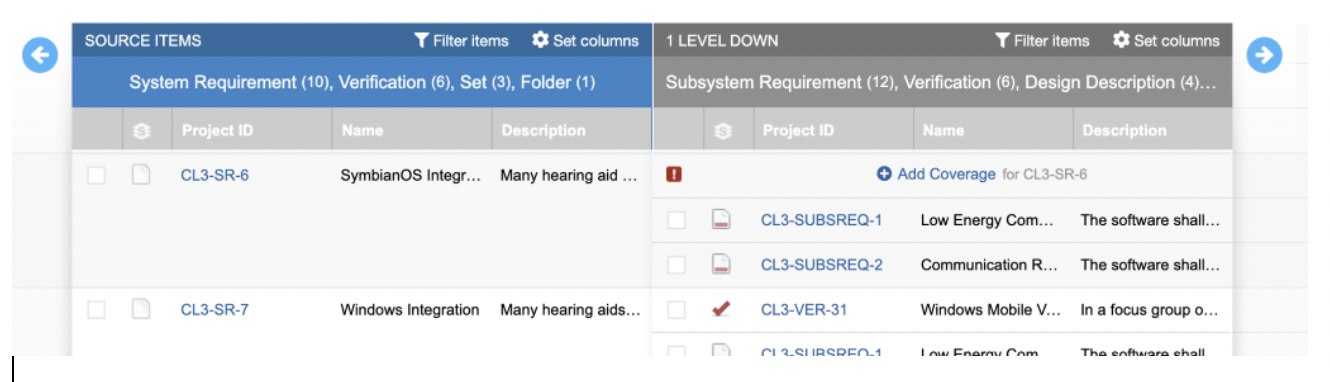

- Increase visibility across all development activities

- Empower your business analyst organization

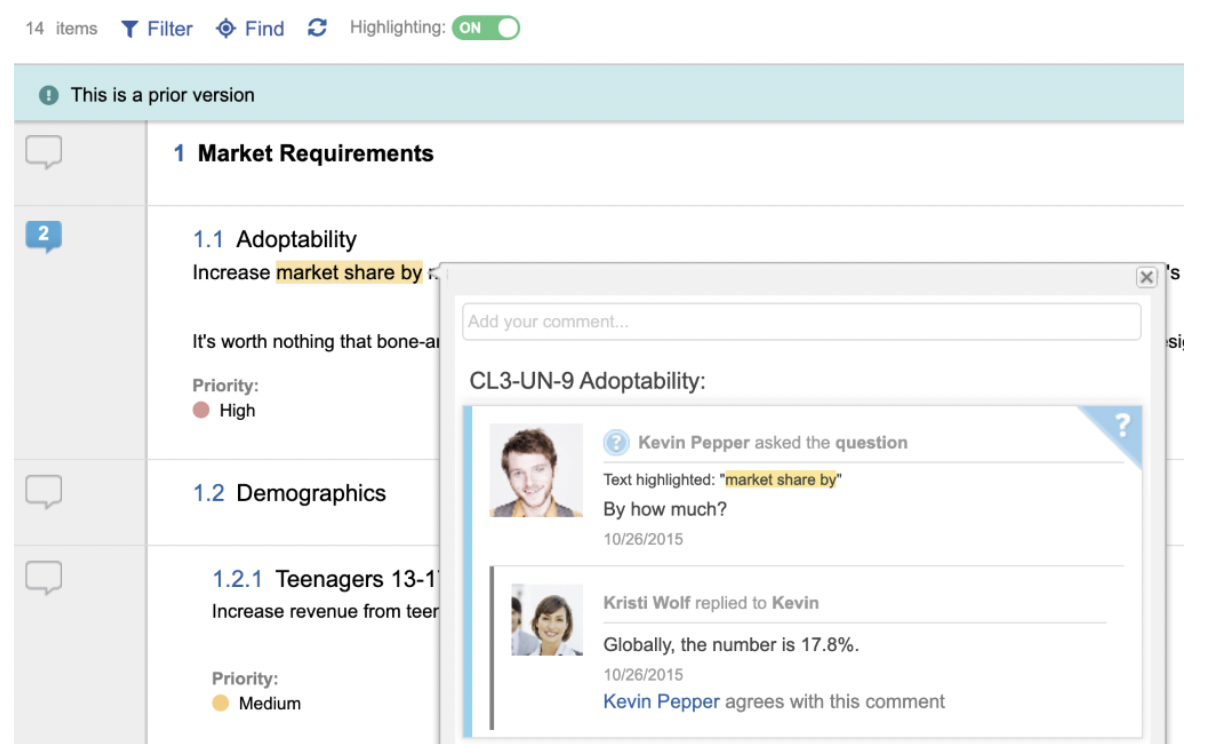

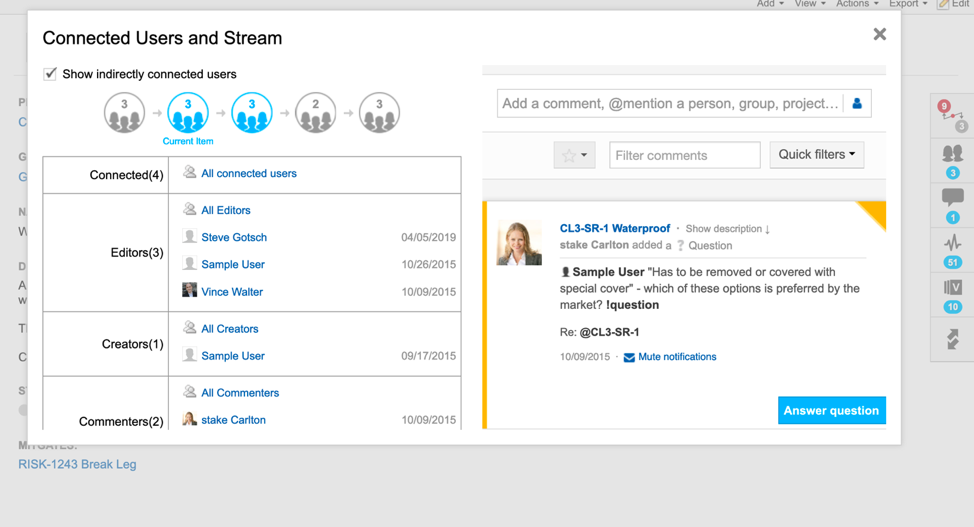

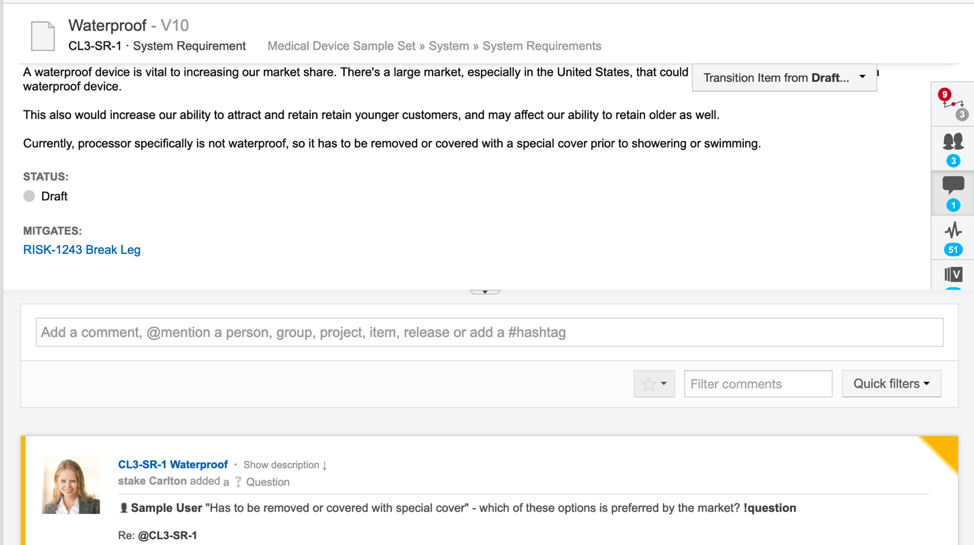

- Enable real-time collaboration across all development teams

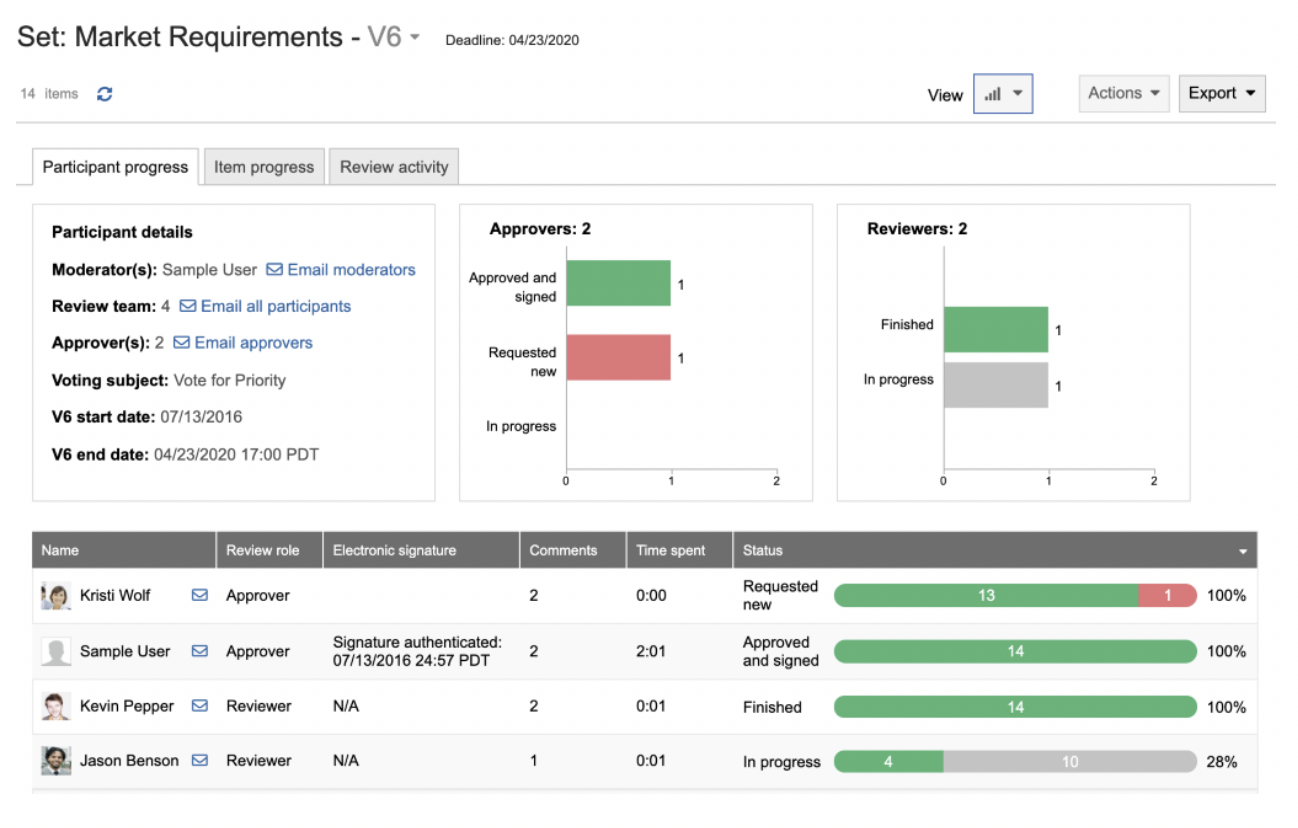

- Track decisions efficiently to avoid rework

- Benchmark and monitor team performance over time

Below is an abbreviated transcript and a recording of our webinar.

Simplifying and Optimizing Processes in Complex Insurance Product Development

Carla Alavarez: When we think about product, we as consumers within our everyday purchase products for a variety of reasons. It’s no different in insurance. As an individual or business, there’s products for purchase that in exchange provide a level of production. So depending on a carrier, this could be a product tailored to meet your specific need or suite of products that can serve you both on a personal and commercial basis. As we look where the industry is headed, we’re starting to see a shift in the product development and how a traditional product is packaged, marketed and sold. An example of a traditional insurance product is personal or business auto insurance. With the shifting behaviors in the market, we’re seeing a shift in the way people are working. You either had them being in a hybrid or full remote position, so the amount that individual is on the road is decreasing.

Auto insurance product is one of the more developed in today’s markets. It has been modernized and redeveloped to meet driver protection needs today with new product offerings, such as usage base or pay as you go insurance. These newer products focus on providing protection and pricing based on the customer’s needs today, versus how it’s traditionally annually rated and priced. So with the shift in technology and customer protection needs, the product development is key to remaining competitive in today’s market.

Related: Simplify Complex Insurance Product Development with Jama Connect®

Brian Morrisroe: Great. Thank you for that clarity, Carla. I appreciate it. So, Alan, we’ve mentioned that the industry’s becoming more complex. Can you talk to us a little bit about what is the current state of the industry as it relates to PNC space from your perspective?

Alan Demers: Sure thing, Brian, thank you for having me as well. There’s a lot going on in the PNC insurance industry. That’s probably an understatement. So when you think about the whole industry, very highly competitive going through lots of change to modernize, that’s probably the headline. Other influences such as climate and cyber risk workforce inflationary pressures, those are more current issues that are really creating a lot of change and a lot of pressure to what’s all already a turbulent space. So cost of materials, parts, medical services, they’re all rising. We know that, and that goes into inflationary pressure, which puts higher premiums and really causes companies to think a lot about their pricing. Really at the top, the PNC market’s been more competitive than ever. This is especially true in home and auto. Market share battle among the top 10, especially the top five, is continually shifting.

There’s been some acquisitions along the way. There’s also this shift for a lot of the multi-line carriers to balance both their commercial along with their home and auto lines. Future of mobility is maybe driving some of that in the future projections on where auto insurance might be down the road. Then the other overarching issues that carrier facing is the cost of customer acquisition and high underwriting costs along with a desire for speed and ease. So that’s kind of the backdrop. Then, more precisely, there’s just been this explosion of external influences through InsureTech movement. Then that’s combined with the internal innovation efforts that many of the carriers are going through. I would say all the carriers are going through that.

Related: A Guide to Requirements Elicitation for Product Teams

Alan Demers: Digitizing and growing digital adoption, that creates higher demand and higher consumer expectations at the same time. But that’s really where the industry is trying to get to is more self-services, more digital offerings to help bring down some of those costs. Then really a shift from traditional insurance protection to more avoidance and mitigation of loss. I think this is one of the more exciting developments in the industry because we all can relate to you buy an insurance policy and hope that something bad doesn’t happen. The industry is really there to help pay and protect you that way, which is a good thing, but even better if there is technology that can be deployed to help you avoid a loss or mitigate it all together at the beginning.

So some of the product, and Carla mentioned this, there’s a number of new products that should companies are launching. Usage in behavior-based auto insurance is a pretty popular one. Sensor technology for detection and avoidance, that could be to avoid a collision such as distracted driving avoidance or detect a leak in a home that may cause further water damage. Embedded insurance is really a trending topic. You can gauge whether it’s a buzzword or if it’s a real thing, but what’s changed about embedded insurance is just the opportunity to combine insurance at the point of sale and do that much easier with today’s technology.

Then finally, personal cyber protection and work from home, which is really a new thing because of the pandemic and the shift and hybrid work models and so forth. So really, when you think about nearly every part of insurance is going through some form of change and modernization, whether it’s distribution, underwriting, servicing customers or claims, and likewise new insurance models are inspiring new insurance products. So really a lot happening and it’s really translates to demand for new insurance protection.

RELATED