In this blog, we recap our whitepaper, “Bridging the Gap in Insurance Product Development: How Jama Connect® Can Streamline Requirements Management” – Download the entire thing HERE

Bridging the Gap in Insurance Product Development: How Jama Connect® Can Streamline Requirements Management

In an industry as longstanding, complex, and regulated as insurance, it’s easy for inefficiencies to creep in. Companies use the same old systems and processes that others have used for decades, and in the crunch to manage the day-to-day business, the drive to update and streamline can get lost in the shuffle.

But in the modern business world, where everything moves at the speed of the Internet and consumers expect new and improved products constantly, insurance companies can’t afford to fall behind on product upgrades and new product development. Old systems and processes keep products from getting to market in a timely manner. How can insurance product developers keep up with demand while meeting business needs and regulatory requirements?

The right requirements management solution can help bridge the gap between product development and the marketplace.

Where The Insurance Industry Needs Requirements Management: Two Scenarios

There are two main scenarios where requirements are needed in the insurance industry. The first is in the policy administration systems that automate the day-to-day operations of an insurance company. While every insurance company is unique, most share processes for day-to-day operations and have some kind of policy administration system. It may be a unique proprietary system, designed specifically for that company, or it may be provided by an outside software vendor. This policy administration system manages the day-to-day operations of the insurance company in three areas:

- Policy Administration: To administer an insurance policy, the company must quote, bind, and issue the policy and process endorsements, cancellations, reinstatements, and renewals.

- Billing/Accounting Administration: The policy administration system must also manage the financial side of each policy. This administration involves processing initial down payments and providing payment plan options; processing cancellations or reinstatements around non-payment of premiums; processing refunds and collections; and producing an annual statement and statistical reporting.

- Claims Administration: Finally, the policy administration system must process insurance claims, including first notice of loss, claims payments, and reinsurance.

Even listing the basic types of information that must be processed doesn’t capture the complexity of the details that have to be managed by the policy administration system. For example, while there is one set of requirements related to insured risk and coverages, there is an entirely different set of requirements for the output to describe both static and variable data that must be printed. In addition, every policy needs to have changes at some point, which are processed as endorsements. There are different rules for different types of endorsements, which will be captured as separate requirements. At each stage and level of the policy there are different requirements that must be applied.

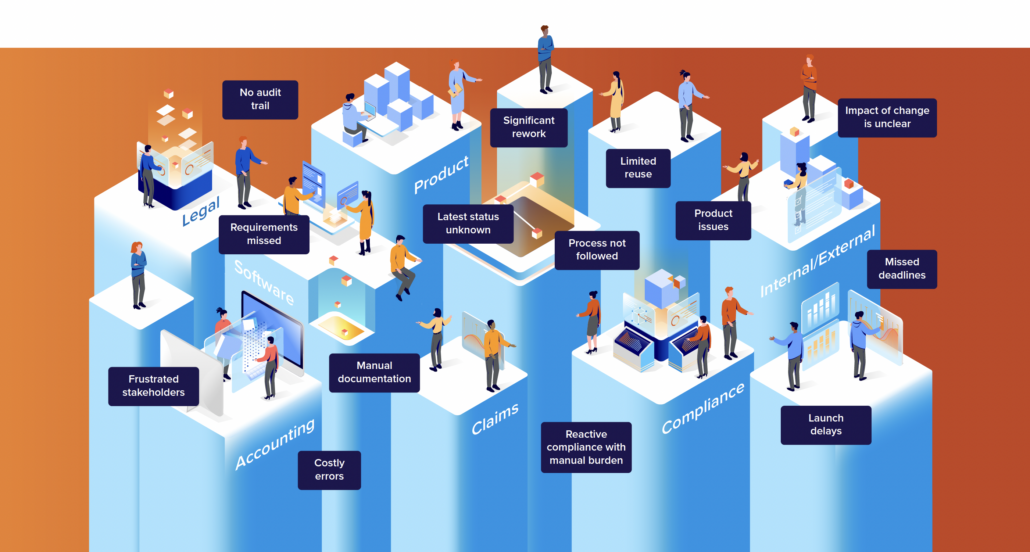

The list of requirements across different functions and processes in the insurance industry is almost endless; managing these requirements according to the massive number of variables across products, risks, jurisdictions, and so on can quickly become overwhelming and cumbersome. In addition, when the requirements aren’t managed or applied properly, gaps and errors can easily arise, leading to administrative challenges at best, legal challenges at worst.

The second area where the insurance industry needs requirements management is in the new and enhanced insurance products and services that insurance companies want to develop and roll out to customers. Designing and introducing new products and services involves new states or geographies with different rules and regulations. Enhancing existing products can involve rate changes or additional coverages. In addition, with new or enhanced products, the policy administration system will need new or upgraded interfaces and other upgrades to the system. Introducing even one new or enhanced product can cause system-wide ripples that can impact everyone from the corporate office to the local agent.

In a world this complex, with this many details, insurance companies need a purpose-built requirements management system to allow them to effectively and efficiently respond to change.

RELATED: How to Solve the Top Five Challenges for Insurance Product Development

Gathering, Documenting, and Reusing Requirements

The common thread to implementing a robust and comprehensive policy administration system is understanding the requirements of the core business processes.

- Business requirements are the needs of the company, regardless of whether there’s a system to process the work.

- Stakeholder requirements are the requirements needed for a specific user to be able to process that information in a specific type of system, but they do not need to be specific to the system. These requirements are the ones that a user (such as an agent or claims adjustor) would need to accomplish the business requirements.

- Solution requirements (functional and non-functional) are the technical requirements that each software solution must have to accomplish stakeholder requirements.

The big key to gathering requirements in all three areas is that the requirements must be reusable. While each software company may have a preference on the format used for the implementation, the business and stakeholder requirements should be reusable within any system so that software requirements can be tailored to the specific implementation strategy.

The Four Main Challenges for Insurance Requirements Management

There are currently four main challenges facing the insurance industry when it comes to requirements management.

1. Introduction of Agile Methodology

The move to agile methodology created a mindset in the insurance industry that requirements weren’t necessary for software development and upgrades. Shortly after the agile revolution began, the IIBA, International Institute of Business Analysis, which is the governing body for business analysts, suggested that business analysts had to adjust to this methodology by evolving to support these new ways of working—not just in software development, but in any area of business analysis where changes happen rapidly. Since then, business analysts often say, “requirements are in the code,” suggesting that requirements are just an extra step that takes too much time.

The reality is that not everyone is a developer who can read and interpret code. Business analysts know the requirements of the business and stakeholders, but they don’t necessarily know how to gauge whether the software meets those requirements. Likewise, software developers may not know the needs of the insurance business without someone who can communicate requirements.

Requirements and requirements management are essential for project success, in part because they reduce the risk of project failure or cost overrun. The solution is not to eliminate requirements to work faster; rather, it’s to manage requirements more efficiently to meet the demands of the market.

2. Unwillingness to Change Outdated Requirements Processes

Change is difficult for a lot of reasons, and it’s not uncommon to hear “we’ve always done it this way” or “if it’s not broken, we don’t need to fix it.”

However, outdated methods of requirements management cannot keep pace with modern needs, and relying on old processes inhibits new product development and innovation. Business analysts should be catalysts for change and demonstrate the efficiencies of new processes throughout the organization.

Another obstacle to change is summed up by the statement, “we’ve managed without requirements management all this time—why is it so important that we do this now?” This attitude represents a misunderstanding about requirements in general. They have always been necessary, and they’ve always been around, whether documented in a specific way or simply discussed in general terms.

Unfortunately, adding new processes to consistently use and reuse requirements can sometimes mean extra work that nobody has time for. Again, this is where business analysts can step

into the fray and be catalysts for change.

3. Reliance on Document-Based Requirements Management Tools

Too many insurance companies rely on document-based tools such as Microsoft Excel spreadsheets and Word documents to manage requirements. These tools are just too time-consuming to manage and can become quickly obsolete if they’re not consistently and constantly updated. It’s also very cumbersome to provide appropriate traceability for testing and test planning using these types of tools. Imagine trying to sit down with four or five different Excel documents and trace the requirements all the way through!

4. Complex Collaboration Across Teams, Departments, and Stakeholders

There is often a great deal of difficulty collaborating within teams, departments, and various stakeholders involved on a project. When it comes to developing and launching new insurance products, collaboration is vital to success, but coordinating schedules and sharing documents can often result in confusion. Fragmented collaboration also introduces the risk of siloed activities and tools; when teams and tools exist independently of one another in different formats and processes, coordination and collaboration become cumbersome at best, impossible at worst. Old tools and processes introduce risk, whereas modern requirements management systems allow people to collaborate at their own pace and provide documentation necessary to clarify and approve requirements.

To solve these challenges, any requirements management system adopted by insurance companies should address four main issues:

- Maintenance and Traceability: The system must allow requirements to be easily maintained and traced across all teams, stakeholders, and functions throughout the development process. Having the ability to quickly identify requirements and their related functionality is essential for making informed decisions quickly. Lack of maintenance and traceability can lead to major product delays and make it difficult to shift resources from core business tasks to breakthrough innovation initiatives.

- Easily Adapt for Future Innovation: A requirements management solution for insurance should allow current state requirements to always be ready for future state innovations, drastically reducing the time to market for new and improved products. Having the ability to integrate existing requirements with new functionality is essential to quickly move breakthrough innovative initiatives from development to market.

The traceability functionality really drew Farm Bureau Insurance to Jama Connect because it is easy to identify within the workflow.

“Traceability in Jama Connect® makes it easier to assess the impact of a proposed change,” says Blundy. “It helps identify all areas we have to modify and then gives us the ability to route the change for review and approval with ease. A single source of truth also improves consistency, for example, having templates built into Jama Connect — with all templates located in a single spot — means we’re all using the same template. And we’re following the same processes when writing, sending, and closing requirements.” – HEIDI BLUNDY, BUSINESS AND TECHNICAL ANALYST AT FARM BUREAU INSURANCE

- Standardization of Reusable Requirements: Having a standard way to reuse existing requirements reduces the risk of project failure, achieves cost savings, and ultimately increases customer satisfaction and return on investment. With standardized requirements, team members who need to review and respond to the requirements can perform their roles more effectively and efficiently.

- Centralization of Requirements: Effective collaboration in the development of insurance products is vital to successful product development, and having your requirements in a central place to quickly find and use is key to effective collaboration.

DOWNLOAD THIS ENTIRE WHITEPAPER HERE:

Bridging the Gap in Insurance Product Development: How Jama Connect® Can Streamline Requirements Management

- 9 Strategies To Overcome Challenges In The EU Medical Device Market In 2025 And Beyond - February 6, 2025

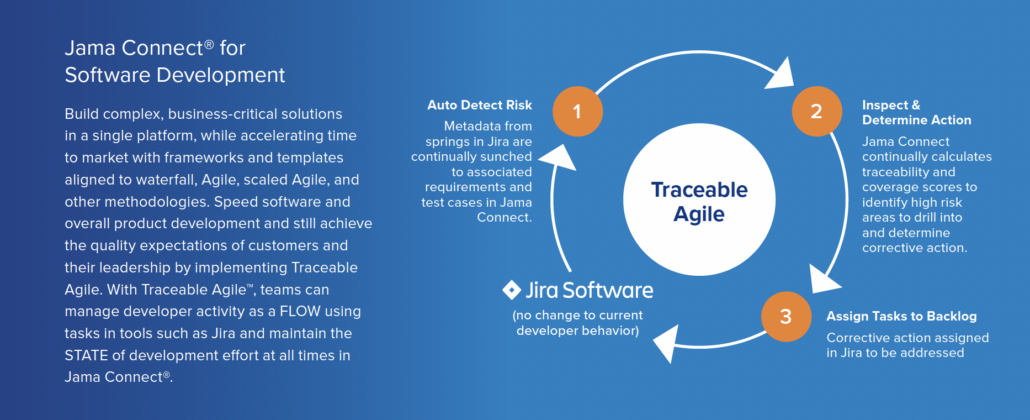

- Leveraging Jama Connect® and Jira for Enhanced Requirements - January 30, 2025

- With Hacks on the Rise, Manufacturers Hone Their Cybersecurity Smarts - January 23, 2025