Jama Software is always looking for news that would benefit and inform our industry partners. As such, we’ve curated a series of customer and industry spotlight articles that we found insightful. In this blog post, we share an article, sourced from Innovation News Network, titled “Benefits of the Inflation Reduction Act for Solar PV Manufacturing” – originally published on March 18, 2024.

Benefits of the Inflation Reduction Act for Solar PV Manufacturing

The US Inflation Reduction Act (IRA) has been a significant catalyst in the economic landscape, particularly within the solar photovoltaic (PV) manufacturing industry.

This article will explore the beneficial impact of the IRA on this green technology sector, considering the financial implications, the stimulation of technological advancement, and the prospects under the current legislation.

We will unravel the intricacies of this relationship, setting a foundation for a comprehensive understanding of the future trajectory of the solar PV manufacturing industry in the context of the IRA.

Understanding the Inflation Reduction Act

To fully grasp the impact of the Inflation Reduction Act on solar PV manufacturing, a comprehensive understanding of this legislation is necessary.

The act’s interpretation is rooted in the law’s intent to curb inflation by manipulating economic strategies and regulating financial practices, which brings a focus to its economic implications.

At its core, the IRA aims to stabilize pricing and enhance the dollar’s purchasing power, inadvertently promoting the affordability of renewable energy technologies like solar PV manufacturing.

The legal provisions of the act are its foundational pillars, governing its implementation and enforcement. They outline the responsibilities of key stakeholders, the rights of affected industries, and the penalties for non-compliance.

For the solar PV manufacturing sector, the act’s provisions could potentially reduce production costs and foster competitiveness.

However, like any significant policy shift, the act also brings Implementation Challenges. These can include industries needing to adapt to new economic conditions or potential resistance from sectors negatively affected by the act.

The solar PV manufacturing industry may need to invest in operational adjustments to fully exploit the benefits of the act.

RELATED: Traceable Agile™ – Speed AND Quality Are Possible for Software Factories in Safety-critical Industries

IRA’s impact on solar PV manufacturing

Drawing upon the legal provisions and economic implications of the IRA, we can explore its tangible effects on the solar PV manufacturing sector.

The act, through its policy implementation, has instigated several changes in this sector, notably in job creation, trade relations, environmental impact, and market competition.

The IRA has been instrumental in job creation within the solar PV manufacturing industry. It has stimulated this growth by providing tax incentives for manufacturing companies to enhance their workforce. This policy implementation has bolstered the industry and helped reduce unemployment rates.

Trade relations have also been impacted by the IRA. The act has fostered a more favorable trading environment for solar PV manufacturers by reducing inflationary pressures on imported raw materials. This has enhanced the competitiveness of US manufacturers in the global market, improving the country’s trade balance in the process.

Regarding environmental impact, the IRA has indirectly boosted the use of renewable energy sources. By making solar PV manufacturing more economically viable, the act has encouraged the production and use of solar panels, thereby reducing greenhouse gas emissions.

Lastly, the act has spurred market competition. The reduced inflation rates have made it more cost-effective for new businesses to enter the solar PV manufacturing sector. This has increased the number of manufacturers, promoting a more competitive market and a wider range of options for consumers.

Financial benefits of the IRA

Delving into the financial benefits of the Inflation Reduction Act, we observe a significant enhancement in the economic viability of the solar PV manufacturing sector. The IRA offers multiple rewards that collectively contribute to the growth and prosperity of this industry.

One of the most compelling benefits is the provision of tax incentives. These incentives lower the tax burden for solar PV manufacturers, freeing up capital that can be reinvested in the business.

This leads to investment growth, another key benefit of the IRA. Increased investment enables manufacturers to expand their operations, purchase new equipment, and hire more employees, fostering business expansion.

In addition to tax incentives and investment growth, the IRA promotes cost efficiency. By reducing the inflation rate, the act increases the purchasing power of manufacturers. This allows them to acquire raw materials and other necessities at lower costs, thereby improving the bottom line and encouraging economic stability.

Moreover, economic stability is further enhanced as the IRA helps to stabilise the value of the dollar. This is crucial for solar PV manufacturers, who often deal in international markets. A stable dollar value reduces the risk of currency fluctuations, providing a more predictable business environment.

IRA and technological advancements

Building on the economic implications, the Inflation Reduction Act also catalyzes technological advancements in the solar PV manufacturing industry.

By providing financial incentives, the IRA stimulates technological investments, leading to accelerated innovation in solar PV technology. These investments are crucial for research and development, enabling companies to explore new, efficient methods of solar PV production.

The IRA implications on technological advancements are significant. The policy’s effectiveness in encouraging investments has been reflected in increased technological breakthroughs, improved production processes, and enhanced solar panel efficiency.

These advancements not only strengthen the industry’s competitive edge but also contribute to environmental sustainability by promoting cleaner energy sources.

However, advancement challenges persist. The rapidly evolving nature of technology necessitates continuous investment and innovation. Despite the financial benefits provided by the IRA, the high costs associated with advanced technology development and implementation can pose a hurdle.

Therefore, while the IRA has been instrumental in fostering growth and innovation, addressing these challenges requires strategic planning and sustained commitment.

Moreover, the effectiveness of the IRA in driving technological advancements is contingent on a supportive regulatory environment. Policymakers must ensure that the IRA’s provisions align with the industry’s evolving needs, encouraging continued investment and innovation.

A dynamic policy framework can help maintain the momentum of technological progress, ensuring the solar PV manufacturing industry’s long-term competitiveness and sustainability.

RELATED: Jama Connect® for Traceable MBSE™

Future solar energy prospects under the IRA

Looking ahead, the Inflation Reduction Act holds promising potential for the future growth and development of the solar PV manufacturing industry.

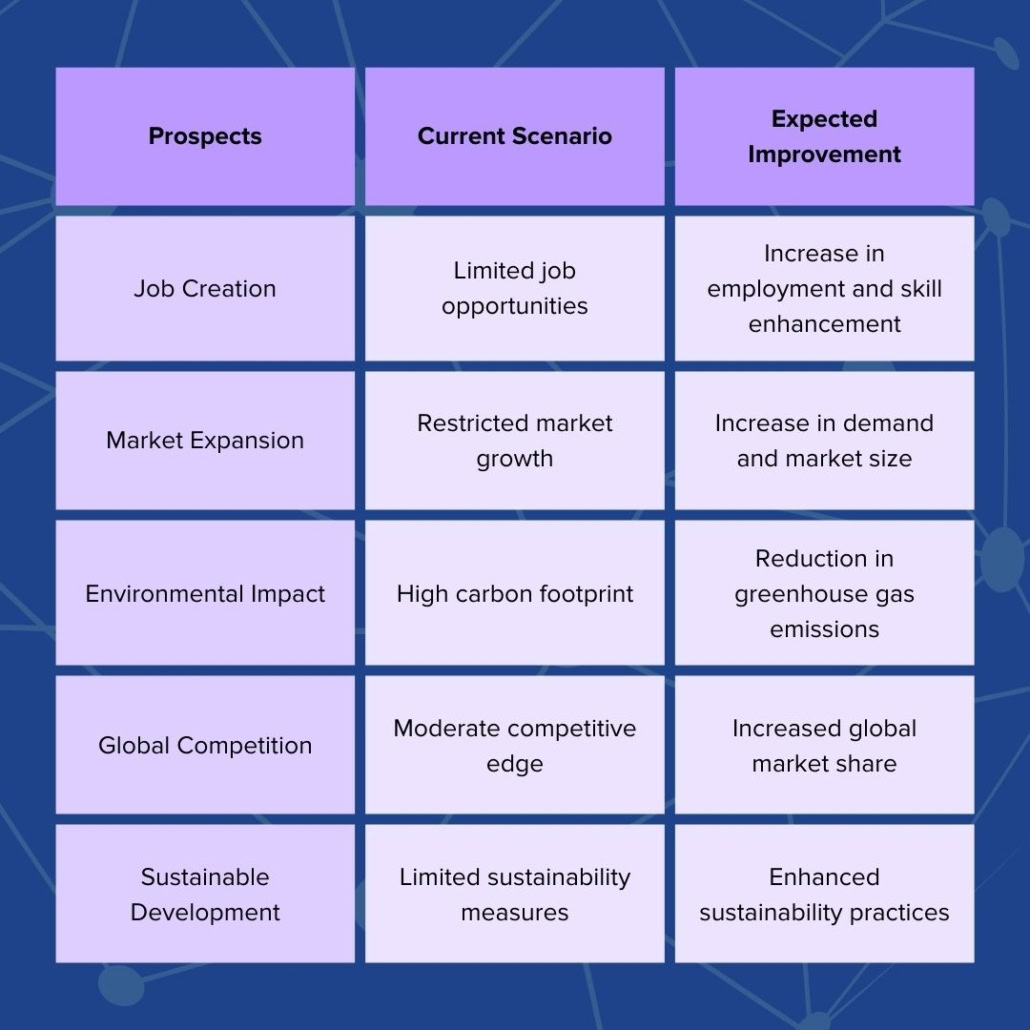

It is expected to usher in advancements in various dimensions, including job creation, market expansion, environmental impact, global competition, and sustainable development.

The IRA could stimulate job creation by allocating funds for research, development, and manufacturing processes in the solar PV industry. This would not only increase employment but also enhance the skills of the workforce in this thriving sector.

Market expansion is another potential benefit of the IRA. With reduced inflation, the purchasing power of consumers is likely to increase, leading to heightened demand for solar PV products. This would pave the way for the expansion of the solar PV market.

The table below encapsulates the future prospects under the IRA for the solar PV manufacturing industry:

The IRA could bring about positive environmental impacts by encouraging cleaner energy production, thus reducing greenhouse gas emissions.

Additionally, it could enhance global competition by providing the US solar PV industry with a competitive edge.

Lastly, the IRA could foster sustainable development by promoting environmentally friendly and sustainable practices in the industry. These prospects under the IRA paint a bright future for the solar PV manufacturing industry.

- Synopsys Bold Prediction: 50% of New HPC Chip Designs Will Be Multi-Die in 2025 - March 27, 2025

- 9 Strategies To Overcome Challenges In The EU Medical Device Market In 2025 And Beyond - February 6, 2025

- Leveraging Jama Connect® and Jira for Enhanced Requirements - January 30, 2025